Our Performance

For many investors, a straightforward strategy based on quality investing is just one part of the puzzle. You likely hold other asset classes like bonds, cash or cash equivalents, and real estate. And you’re likely looking for more defensive strategies. That’s where “The Theta Tortoise” has you covered.

Firstly, we pick reliable low-risk stocks, as we shared in the below research article. In combination with options strategies, they’ve proven to be great wealth-creating machines. Still, there’s downside risk as we’re fully exposed to stock ownership.

Avoiding Complete Meltdowns

While the stock market is a great vehicle for long-term wealth compounding, there have been nasty drawdowns that took a long time to recover from. Not every investor is mentally prepared for such steep declines, and many are shooting for the highest possible returns. That’s where “Strategic Options” can make a huge difference.

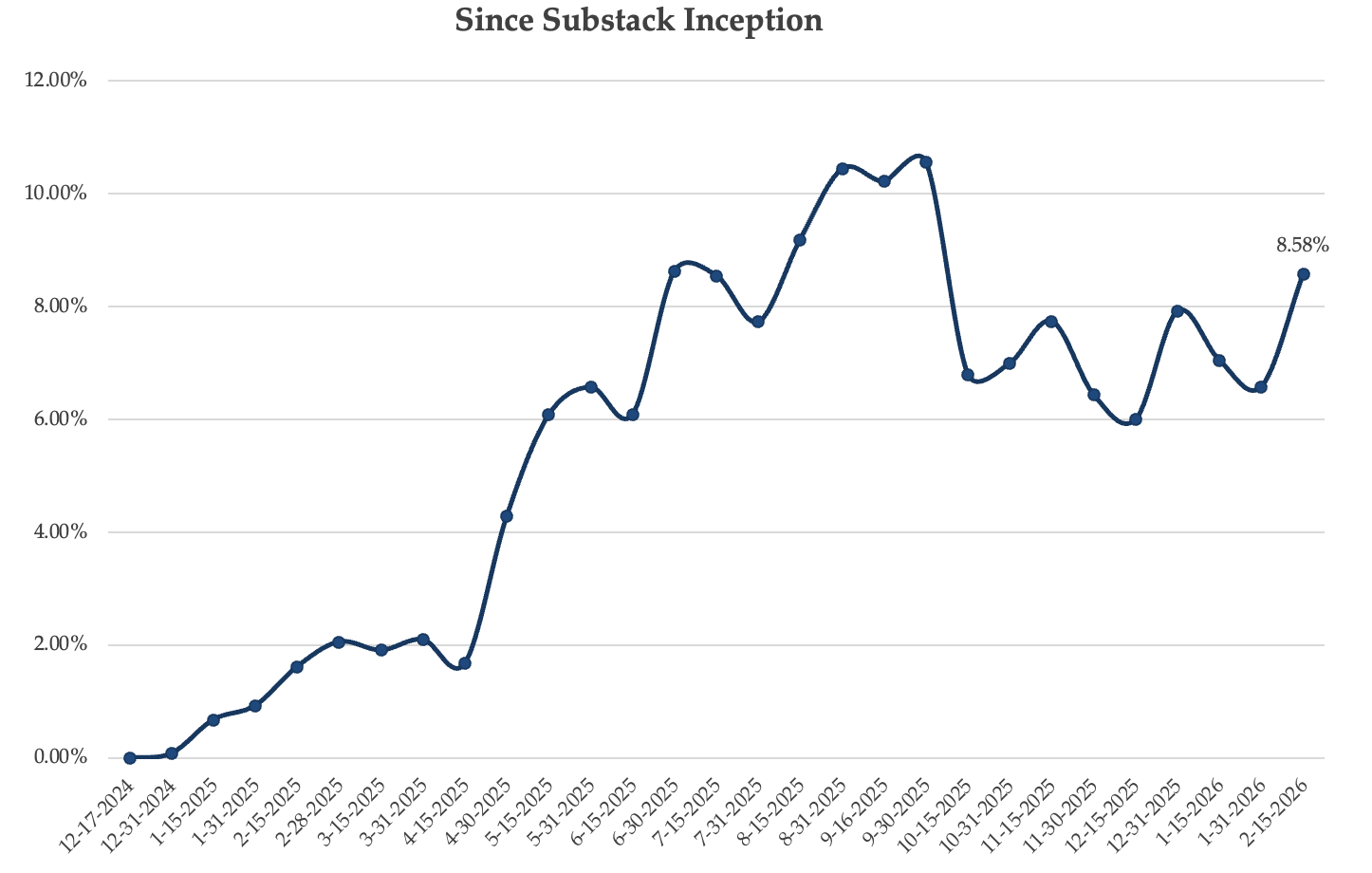

What do we expect from our portfolio? Making money in sideways markets, protecting our downside risk with low-risk equities, and taking advantage of opportunities with our sizable excess cash position. More specifically, our positions involve shorter-term and longer-term setups. The annual return goal excl. interest earned on excess cash is 6% to 8%, based on our real-life results and backtesting. Most importantly, our max. drawdown risk is very limited.

Rolling Return

Below you can see the net return (after transaction fees) for our options strategy since December 17, 2024, the date on which we launched our Substack.

The portfolio is built on an initial capital of 200k USD to highlight the defensive nature of our approach and provide sufficient diversification. A lower capital base would imply we’re either using 1-2 stocks or levering up strategy setups, which is clearly not our objective.

Live Portfolio

You’ll find the sheet with our current options portfolio, transactions, and closed positions in every blog highlighting new or closed positions.