The Research Around Covered Calls

Our 2022 paper: low-risk quality stocks w/ selling options outperforms even more

Following last week’s first bi-weekly webinar, we said we would elaborate on our 2022 research paper’s findings (30+ pages). Defensive quality growth stocks combined with options strategies (in this case: monthly covered-call writing) - does the combo work, and how, why, and when?

Low-volatility outperforming high-volatility (through a basket-approach): it’s a phenomenon we’ve been researching since 2019 and even more so during 2020 and 2022. Whilst it is not watertight from a short-to-medium-term perspective, the long-term evidence cannot be denied: highly volatile stocks underperform their steady and less volatile counterparts. The following questions arise:

Why is this the case?

Will it continue to exist?

Should you look at relative or absolute volatility?

What’s the significance of this anomaly vs. other factors?

The Concept of Low-Volatility Investing

Before we go into our paper’s details (and follow-up research), let’s summarize the low-volatility strategy through a previously recorded interview with Pim van Vliet, head of Conservative Equities at Robeco. We’ve inserted some material below.

Conservative Formula

Together with his colleagues at Robeco, Van Vliet developed the conservative formula: a portfolio consisting of low volatility stocks that have high payout yields (dividends and buybacks) and good momentum. While we like this approach, the strategy isn’t sector constraint: it encompasses utilities and telecom stocks that wouldn’t meet our quality growth criteria: high debt, low ROIC, regulation.

Also, in real life, investors would have to pay dividend withholding taxes, incur transaction costs and other items that backtests cannot fully take into account. Fortunately, the low-volatility factor is a long-lasting one: portfolio turnover is not that high (compared to momentum, which is very difficult to implement).

Low-Volatility Effect

According to van Vliet’s research, the low-volatility effect is the biggest anomaly out there. First, it’s not a risk premium. Most of the time, factor premiums are a compensation for risk (like size: small caps outperform large caps but with higher volatility), but with lower-volatility stocks there is a reduction in overall volatility.

The true factor premium becomes visible once you backtest a long-short strategy: long low-volatility, short high-beta (or betting against beta) yields higher returns than the overall market with a similar beta (i.e. 1).

Widespread Evidence

The low-volatility effect can be observed in all equity markets and across various asset classes. The reason why it’s so strong is because very few know how it could potentially be arbitraged. We know why it exists:

Benchmarks: normative baseline to compare your strategy to the index’ performance. There’s a huge tracking error associated with low-volatility stocks. While our goal is to earn 12% per annum, the index will for sure - from time to time - generate returns that exceed ours.

Overconfidence: stock-pickers choose individual stocks to beat the market.

Extremes: one moment, we’re super cautious, the other time, we’re overly bullish/aggressive.

Hedge funds: despite their focus on absolute returns, they’re lurked into high-vol stocks.

Underestimation of Winners That Keep on winning

As we look at the low-volatility anomaly and how it impacts quality stocks, our companies should outperform because of analysts’ under-appreciation of durable long-term compounding in underlying earnings.

Forecast data show that financial analysts are, on average, too pessimistic regarding the future profits of highly profitable companies. This gives rise to the profitability anomaly, which they also find to be particularly strong for firms with persistent profits. As we mentioned in previous episodes, ROIC normally doesn’t mean-revert. Quite the opposite is true for high revenue growth rates.

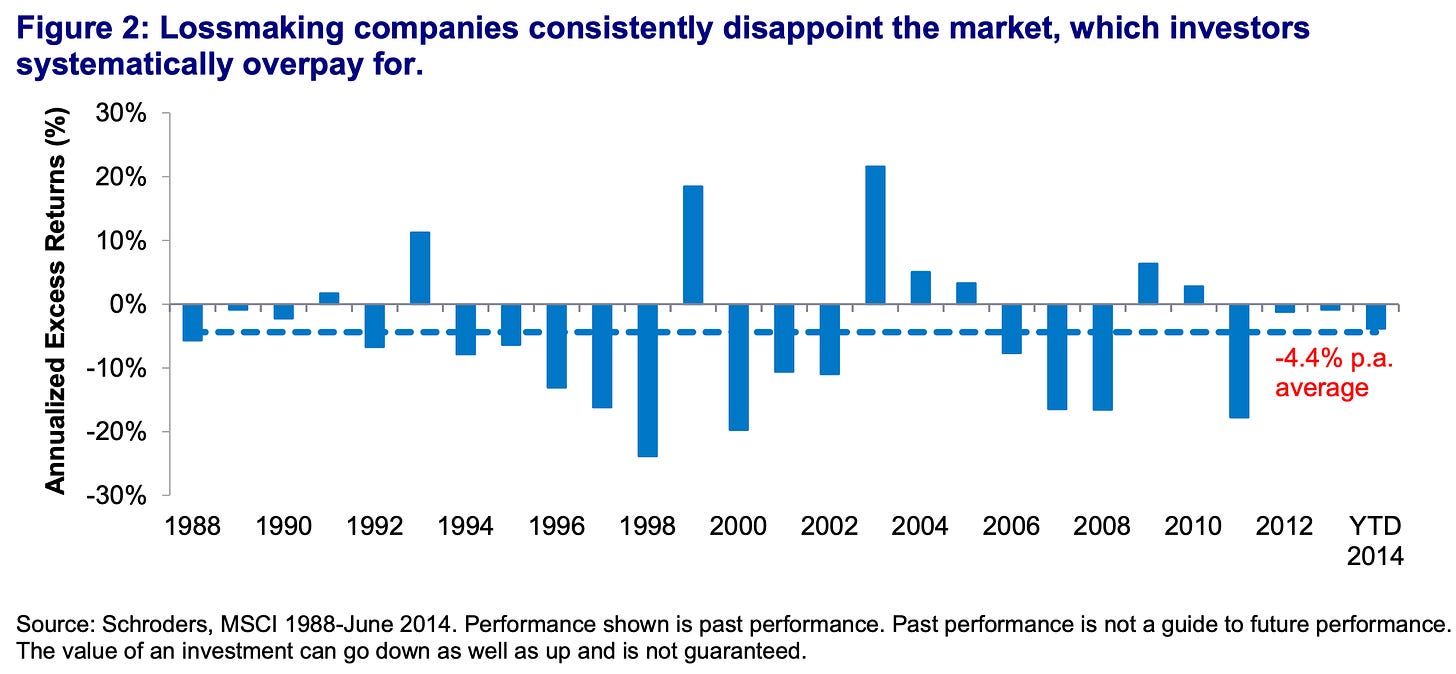

Our defensive quality growth companies are businesses that have already won in their respective industry and on which we have a relatively strong conviction for continued long-term success. Return on Capital is the secret sauce for longevity. Generally speaking, high revenue growth rates and a low return on capital create immense share price volatility. Therefore, we won’t go after fancy growth or speculative stocks that happen to be popular at a certain time; it’s not in our best interest for generating the stable returns we aspire to. Moreover, investors tend to repeadetly overpay for these losing companies.

Relative Performance Makes It Tough if You’re Short-Term Focused

Let’s take a closer look at three of our core holdings in our stock-only portfolio to back this up. We’re looking at the monthly returns over January 2002 - April 2024, risk/reward metrics (Sortino, Sharpe Ratio), and correlation.