Our Strategy Heading into 2025

Boring is beautiful - 1 setup with below-average risk earning you a 1-year return of 7-13%

In yesterday’s article, we talked about boring stocks, selling premium and our study/paper on covered calls. 2024 was another great year for the stock market, but what if next year we’ll go sideways with quite a bit of volatility (spikes, followed by subsequent contraction)? We can’t predict the future, but it’s likely to see more two-sided action over the next years.

As volatility picks up, selling premium becomes more attractive. Still, the effectiveness of a covered call strategy depends on the velocity of the down move and for how long implied volatility will remain elevated.

Let’s see take a look at the strategy Santa brought us this year.

6-8% Returns with Boring Quality

That’s why, for next year, we’re looking to earn 6-8% with our low(er) risk options strategy. Managing risk (and in fact eliminating all downside risk in case of a severe bear market) is key after two excellent years in the stock market.

Only one week left for our Early Bird discount (20% off annual plans)

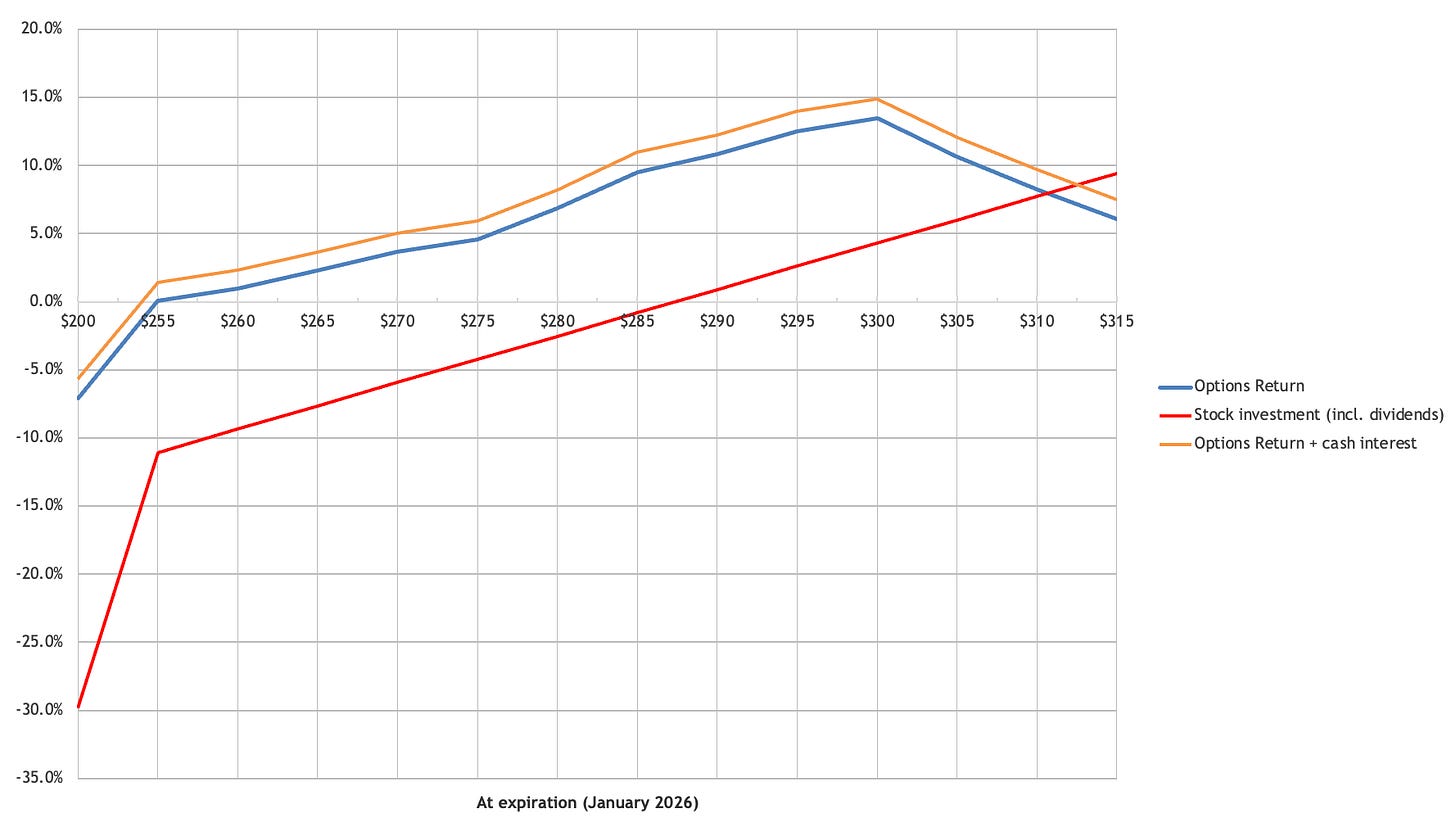

Meanwhile, boring is beautiful. Low-volatility quality stocks have lagged the market, continue to generate a lot of free cash, and with today’s momentum around AI, upside potential may be limited. One of such defensive strategies we’ll be implementing on McDonald’s soon (whenever our limit orders get hit around mid-price, which could be today or next week) has the following pay-off (12.5 months).

The benefit of the strategy is that we’re investing just 1/3 of the cash that’s required to own 100 shares of stock in this options combo, meaning that half of the cash can earn a 3% interest (that’s the percentage we’ve used). All while keeping 20% in cash that’s readily available to take advantage of some shorter-term basic strategies.

As such, the below pay-off reflects the return based on a 29,100 USD investment/portfolio holding MCD. Don’t execute this strategy if you’re replicating a portfolio of 5,000 USD.

Our expectation is for MCD to deliver a mid to high single-digit total return, which we’re looking to double or even triple by benefiting from time decay and protecting our downside risk.

The below graph highlights McDonald’s recent stock price trend. The darker green area indicates where we’ll make a 6-7% return by mid-January 2026.

It’s important to remember that it takes time for the strategy to earn the positive time value. As such, it’s a slow-and-steady return generator.

Implicit Hedge During Stormy Times

What if the stock were to go down for whatever reason (E. coli outbreak, virus, consumer confidence taking a hit and pulling all stocks down, financial crisis)? Our 1-year downside risk will be limited (depending on the drawdown’s severity).

And if the stock plunges by more than 30% with increasing volatility, we’ll be making money! An implicit hedge, while benefitting from a decent return if the stock goes up bit, goes down a bit, or simply zigzags.

Let’s turn to the strategy itself: which options/legs did we select, can we tweak it a bit more based on changing expectations, what about the risks?