Why Boring Will Keep on Winning

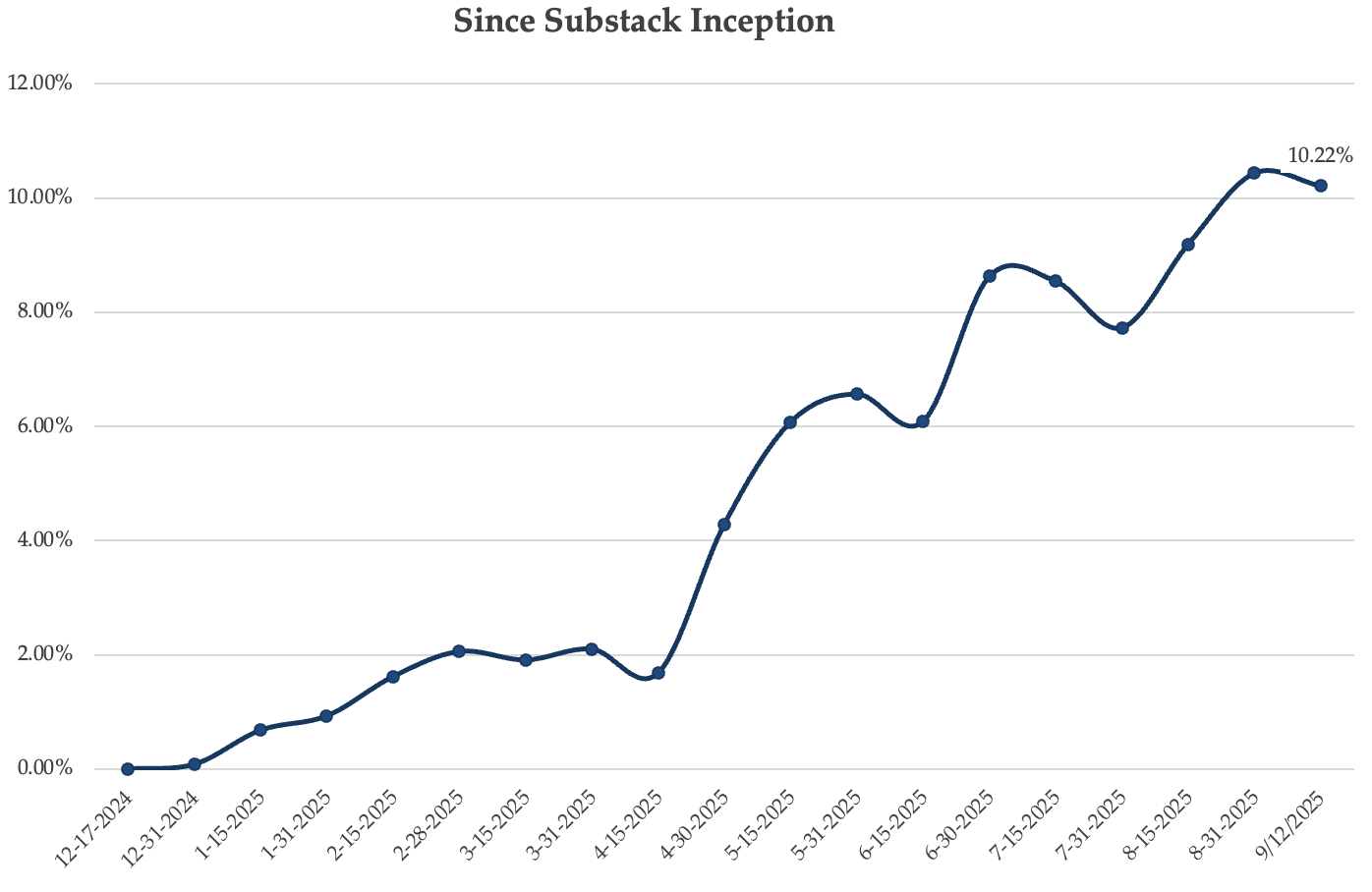

Outperforming the Nasdaq, even though we don't hold tech, plus with lower equity exposure in general

Welcome to this brief bi-weekly update. We’ve received feedback from readers to present future updates in a written format as it’s easier to discuss graphs, our portfolio, et cetera.

Today’s topics aren’t much different from the past weeks’: there’s the AI goldrush, and doing some economic napkin math we highly question the cash returns and embedded expectations for many of these momentum stocks. At the end of the day, long-term stock returns are explained by returns on (incremental) invested capital and growth. If the returns are low, then achieving growth is only possible through issuing new shares and/or borrowing money. Also, the more competition there is, the higher the risk of returns being driven down.

It’s something we’ll discuss in our upcoming Quarterly Letter on our other Substack (The Compounding Tortoise).

Overall, we stick to our own absolute return goals and strategies we’ve been implementing for many years. Also, we want to be able to keep adding capital at attractive returns. We also don’t care about relative performance, especially during euphoric times.

Looking at our portfolio today, there’s still quite a bit of time value and near-term return potential that’s embedded in the 1-year setups. Nonetheless, the return remains solid at +10.22% since December 17, 2024, beating all major US indexes.

Higher returns, lower exposure/risk, and room to scale our exposure whenever we want to. It’s been repeating the same story over and over again - but that’s good. If you’re discussing a defensive strategy that’s working well, you shouldn’t be making significant changes to that approach.