When Fear is High, Opportunity Comes Knocking

VIX as a guiding indicator for contrarians, and a new options position

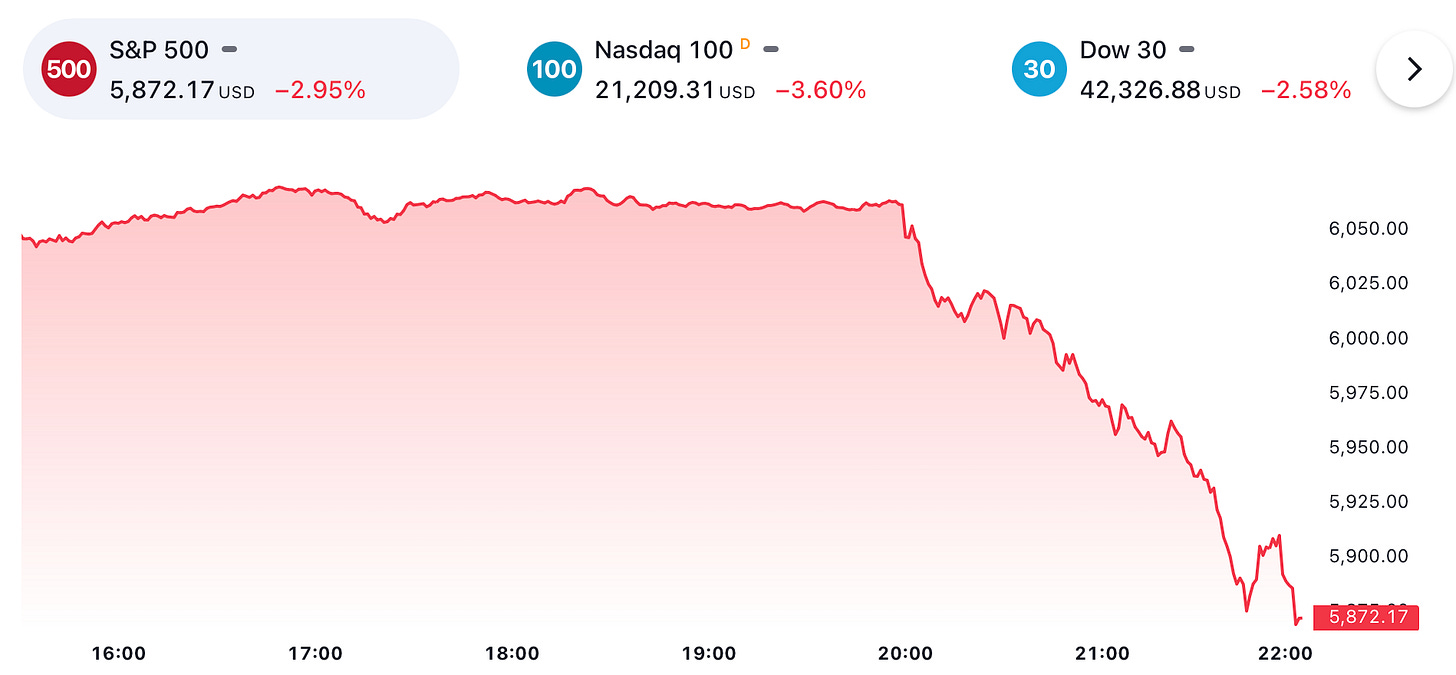

After a few months of apparently low volatility, the VIX (fear gauge) index rose to close to 30% yesterday. The Dow Jones index dropped 1,000 points, and market watchers pointed to hawkish comments from the Federal Reserve’s Jerome Powell: fewer rate cuts amidst a stronger US economy and upward revisions in inflation expectations. Further progress on the latter seems to have stalled.

The VIX index provides a measure of market volatility on which expectations of further stock market volatility in the near future might be based. The current VIX index value quotes the expected annualized change in the S&P 500 index over the following 30 days, as computed from options-based theory and current options-market data. The VIX can be traded through derivatives (options, futures).

When volatility is low, anything can happen: stocks go up because there’s little to be worried about (low inflation, good economic growth, low unemployment). Simply stated, everyone seems to be agreeing on the same positive factors that should keep a stock market rally going.

However, all of sudden, hell breaks loose (e.g. risk-parity funds have to rebalance their positions), causing the VIX to rise and oftentimes markets to decline. This is exactly what happened at the beginning of 2018: many funds were shorting the short end of the volatility curve and a little uptick forced them to cover their positions.

Some VIX-linked products that thrived in the calm of 2017 went belly up, and the number of VIX futures open contracts logged its largest percentage decline in a decade. Losses estimated at $420 billion followed a subsequent one-day surge in the VIX during Oct. 2018. Most notably, the VelocityShares Daily Inverse VIX Short-Term Exchange Traded Note (XIV) lost 94% of its value in just over an hour's trading on Feb. 5, 2018 in the wake of a soaring VIX. Its issuer, Credit Suisse, liquidated the product pursuant to a contractual provision.

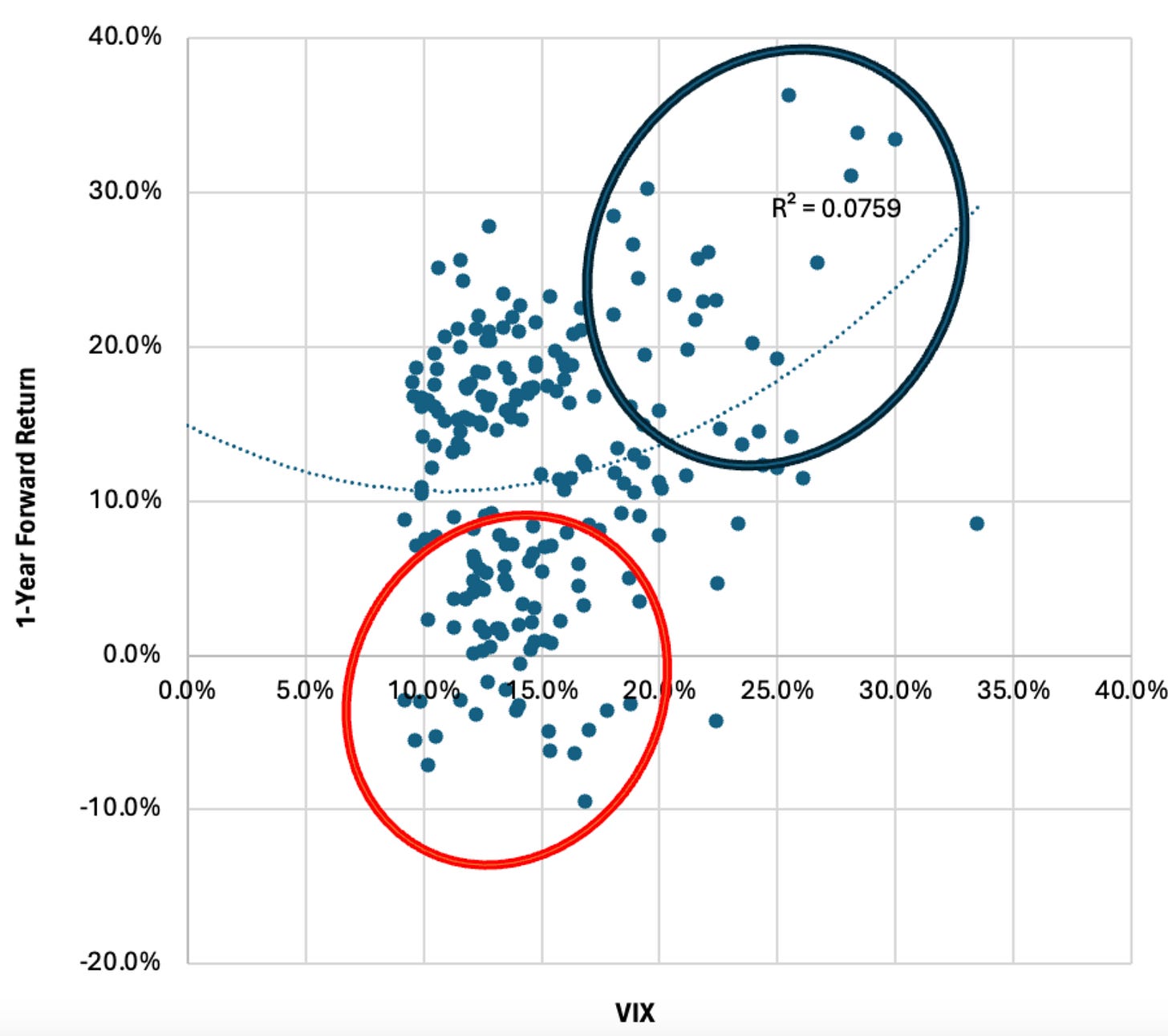

The below graph highlights the relationship between the VIX and the forward 1-year total return for the S&P-500 (we’ve chosen January 2015 - January 2020 to rule out the COVID-19 impact and assess a more typical market environment).

When volatility is high, a correction/market dip (>5%) has already taken place thus implying less risk for new purchases. Conversely, we don’t think there’s strong evidence in a low VIX predicting poor forward returns for our high-quality growth companies. Corrections come and go, but there’s considerable alpha to be earned when you can stoically buy the dip in fundamentally superb businesses!

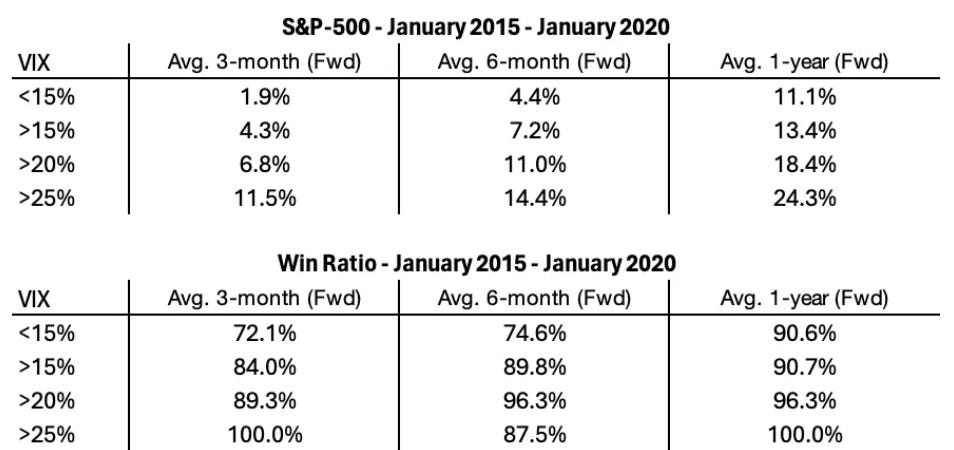

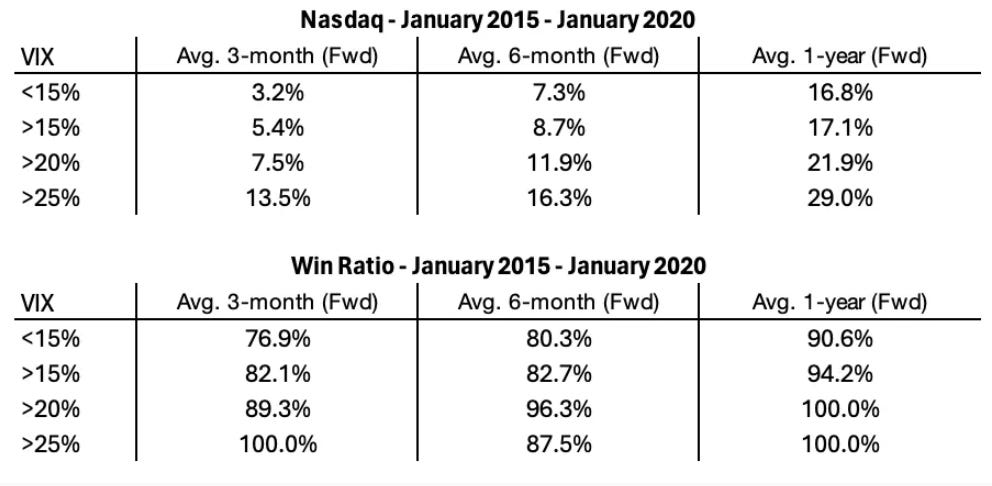

For instance, buying the S&P-500 whenever the VIX exceeded 20% would have translated into an 18.4% forward 1-year return (96.3% win rate) versus 11.1% when the VIX was below 15% (win rate of 90.6%).

The VIX exceeded the 25% threshold yesterday, so based on the above tables (it’s also true for prior periods), one might say that the win rate for new purchases looks pretty compelling. Being contrarian and buying when fear is high.

Of course, that's just based on one indicator. Nonetheless, it’s an important one as it’s based on emotional behavior. People may be vocal about buying the dip, but their actual positioning often tells a different story. If they’re really fearful, they’ll look for protection or sell out. That’s what’s driving volatility: market participants disagreeing on the stock market’s sentiment and/or being forced to cut down their position when the s*** hits the fan.

During market extremes, low or high volatility, options can help balance risk/reward for your entire portfolio. Let’s take a closer look at a new transaction we’re about to execute.