Below you’ll find the sheet with our options positions since the launch of our Substack. Our objective is simple: prudent investing, and being fully transparent about our results, and market opportunities.

A portfolio that’s easy to follow.

First Closed Trade with Ferrari

Today, we closed a Ferrari position for a net profit of $292 (which was entered on Dec 19, 2024), and entered a new trade (benefiting from today’s spike in implied volatility).

Making Money When Directionally Wrong

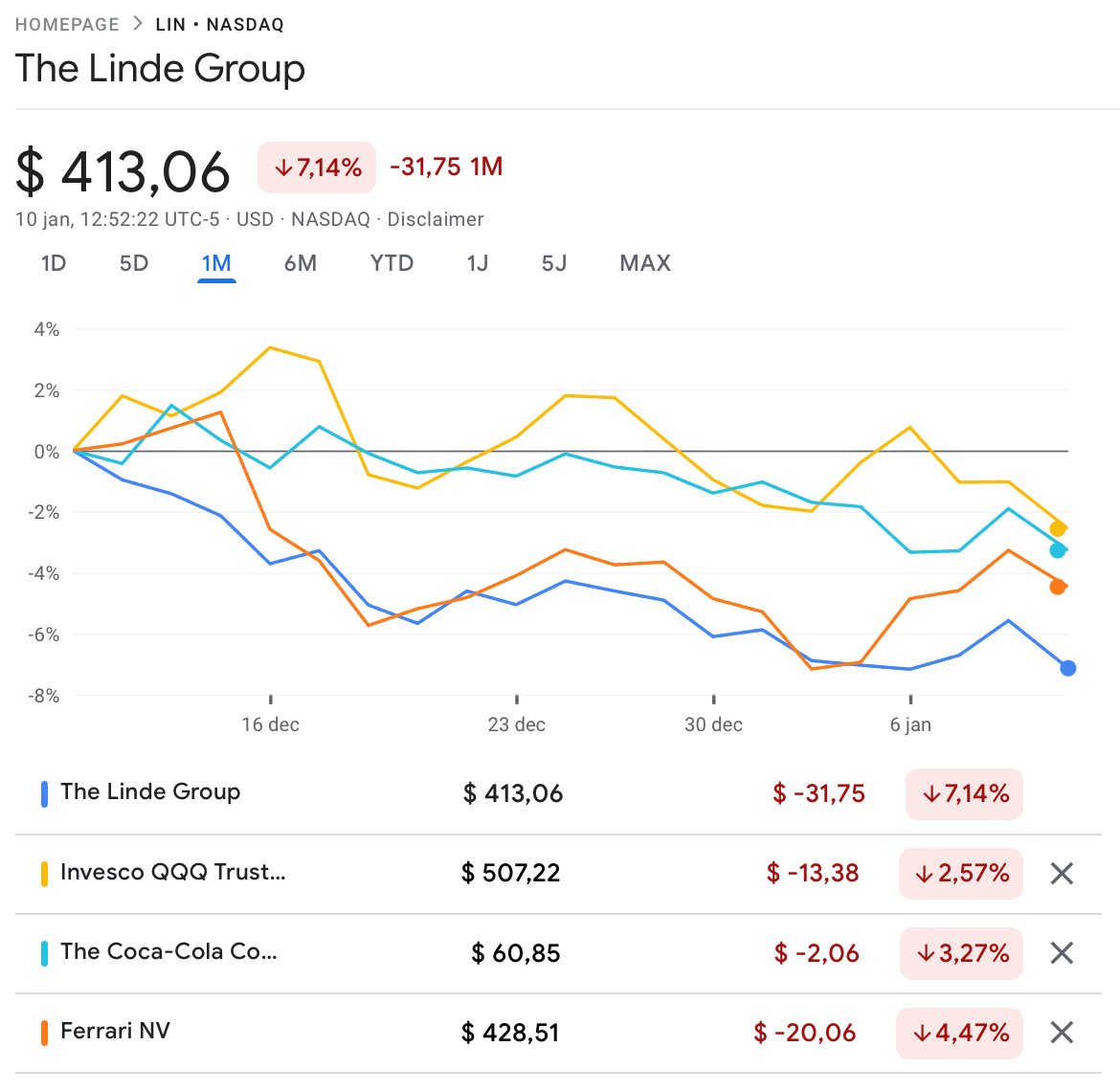

Despite the recent drawdown in the markets, our options portfolio is up slightly with very low volatility. Make no mistake, had you purchased Coke, McDonald’s, Linde, you’d be down quite a bit (less than the Nasdaq, though). Put another way, you could be directionally wrong, but make a profit with options strategies. Or if nothing happens, or if we get a long period of two-sided actions: strategic options provide a much better risk/reward profile.

Losing less means you can grasp more opportunities when downside risk’s already materialized. As we wrote on our Discord:

It's all about the sequence of risk and return. If I can survive a 20% drawdown (without speculating on a crash, or being lucky with my timing, just by being strategic with the options setups), there's more room to be aggressive when the risk's already materialized (and when everyone else starts caring about getting protection).

Our portfolio won’t shoot the lights out if the market rallies, but instead, collecting steady returns and building a cushion is what makes the difference. And based on the rapid growth in our premium membership, we notice that many more investors are increasingly worried about how to optimize risk vs. reward, as part of a broader strategy aimed at maximizing risk-adjusted returns.

Let’s take a closer look at our current positions. The below sheet highlights our portfolio, transactions, and closed positions’ P&L. The goal is to talk strategy and research in our bi-weekly webinars, and ideally, when we’ve just closed out a regular monthly expiration cycle.

We’ve got some nice blogs in the pipeline. First topic to be addressed more extensively: implied volatility, and how it impacts strategy and portfolio positioning.