Pocketing a $300 With Good Old Linde

The stock's down, but we've made some decent money - putting on a new position

It’s regular expiration this week, and given some of the long-term options (LEAPs) expiring this Friday, there could be some volatility.

Today, we’ll be closing our position in Linde, likely pocketing a net profit of $300. We put on this position last month, and since then, the stock’s down. In contrast to owning the stock outright, our options position wasn’t very volatile at all.

Simultaneously, we’re looking to put a new position for February, benefiting from what is still a solid VIX environment to capture time decay.

With the upcoming expiration cycle, it will close out our Portfolio’s first month. Our first two-week P&L was 0.08%, while our first four-week return is set to be close to 0.45% (after transaction fees).

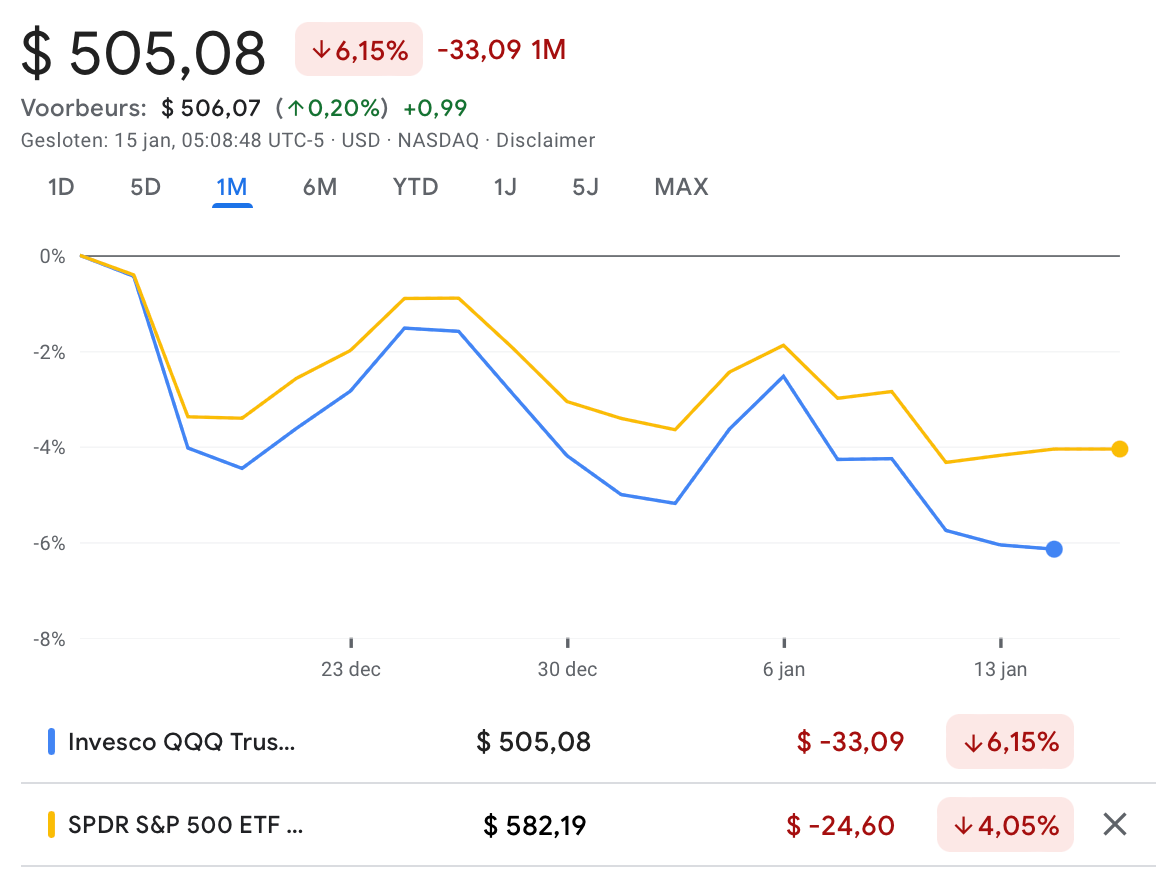

Most importantly, our defensive stock replacement strategies are very slow-generating setups, so we’d expect their returns to tick up gradually over the course of this year. While this may sound “light” or “boring”, the market’s down 6%. We cannot predict the next move, but harvesting a 0.5% - 0.7% for many months with limited downside risk is what gets the conservative investor excited. There’s always risk, it’s just a matter of managing the sequence of risk and return.

There’s a 20% discount off annual plans till the end of the month.

Let’s take a closer look at our Linde position.

One premium member e-mailed us with a question around managing a position early, and we’ll be talking about that in this week’s bi-weekly webinar. So stay tuned.