Buying This Leading Industrial At a 6.5% Discount

When implied volatility's ticking up, implied forward risks decrease

Happy New Year! We’d like to extend our best wishes for a healthy and successful 2025! With a new year come exciting stock market opportunities, and this year will be no different.

Markets continue to be volatile: negative headlines from China, analysts downgrading defensive compounders that have lagged the market, rising oil prices, turbulent European gas prices… You name it. There’s always something to worry about, and that uncertainty creates opportunities.

For conservative options strategies, time is our friend, and we collect more time value if options premiums are juicer. Plain simple. Many do the opposite: selling premium when volatility is low (oftentimes with markets at rich valuations). This is evidenced by the VIX.

Our Recent Performance: Boring’s Good

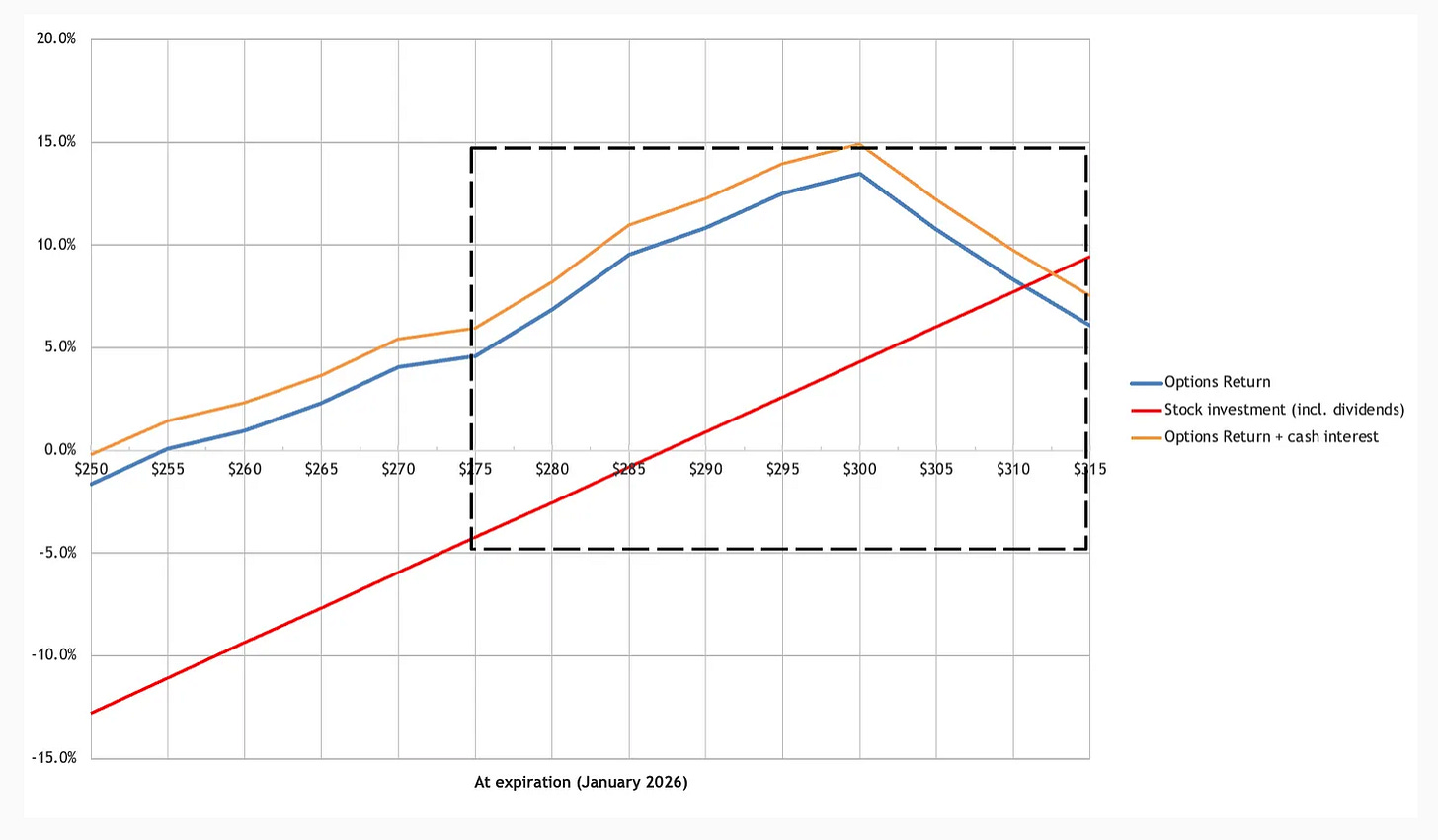

When combining defensive quality stocks with options, you can build a strategy with an asymmetric risk vs. reward profiles: making money in sideways and moderate markets, while capping downside risk if things go south.

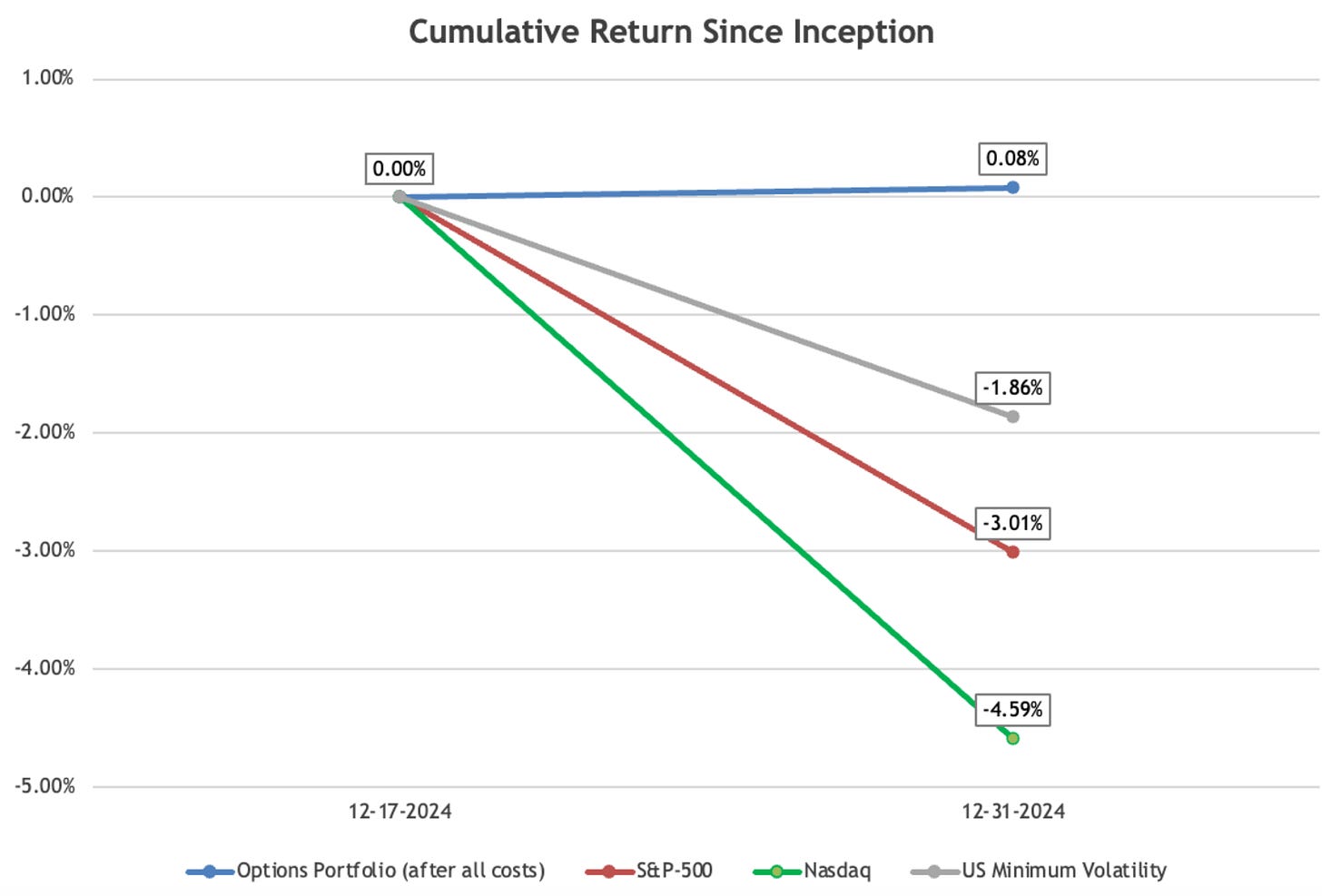

Below you can see the net return (after transaction fees) for our options strategy since December 17, 2024, the date on which we launched our Substack, versus the indexes.

Of course, it’s very early days, but this is the kind of profile you should expect. The longer-term stock replacement strategies collect the targeted return very slowly. For 99% of all investors, it’s frustrating to see such little movement in daily and monthly returns. But, hey, that’s what we want. This portfolio is designed to survive drawdowns and make a 6-8% return over the whole cycle.

The below graph depicts what we mean by “asymmetric return vs. risk”. Of course, one could make +10% returns in one single day with fancy growth stocks, but that’s not our playing field. What goes up 10% could crater 15% the other week…

With volatility increasing, we’ve looked into opportunities to put our excess cash to work. And one of our quality stocks in defensive industrials looks quite attractive: Otis Elevators. Even more so when combining it with an options strategy that allows to buy the stock at a 6.5% discount by mid-February.

On The Compounding Tortoise, we’ve covered Otis in our deep dive and earnings recaps. We’ve cautioned against its valuation, but that’s changing bit by bit. Put another way, when using options, we combine our research on implied volatility with fundamental and sentiment (how’s the market positioned) analysis.

Let’s take a closer look at what we’re planning to do. We’ll be talking about our strategy and setups in this weekend’s Strategy 2025 webinar. Make sure to subscribe, if you haven’t already.