A Simple Yet Effective Strategy With Quality Stocks

Higher implied volatility de-risks cash-secured put selling

Now that we’ve had yesterday’s introduction, it’s time to talk strategy.

Direct Stock Ownership at the Core of Our Strategy

Our personal portfolio approach (as a percent of our liquid investable wealth (excl. emergency fund, savings account for traveling and other stuff)) is as follows:

70-75% invested permanently in quality growth companies through direct stock ownership. That’s transparently shared via “The Compounding Tortoise” newsletter, where you’ll find our 100% pure stock portfolio. It’s our core long-term belief to be invested in smaller-/medium-sized and larger companies that have been around for decades.

25-30% in a separate account with cash, zero coupon bonds (such as this German one) and options. As new excess cash comes in (revenues from business/employment), we’ll allocate it to this account.

The goal is to maintain the purchasing power of idle cash balances, taking advantage of market opportunities, while making sure it’s done in a tax-efficient manner.

The annual return objective is around 5% per annum.

Depending on the size of your stock portfolio, you can mix some basic options strategies up with your long-term stock investments. One such strategy is known as portfolio overwriting, i.e. covered-call writing to earn some additional premium and reduce your aggregate cost basis.

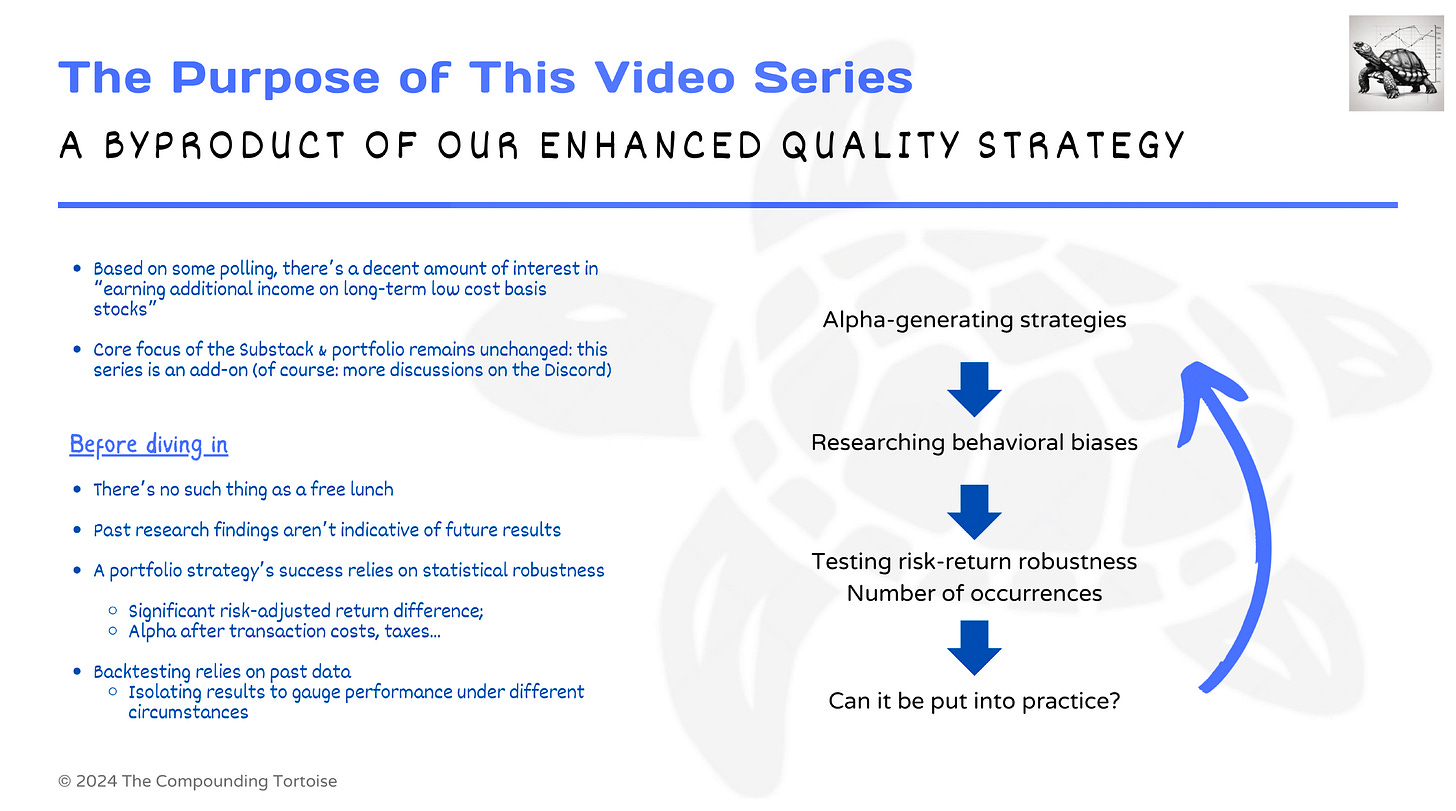

Last Summer, we talked about portfolio overwriting as a byproduct of quality investing strategy. We’ll cover all relevant strategies in this newsletter, and then it’s up to you which strategies (if any) you’d like to implement yourself.

Whether it’s stock investments, derivatives, or any other opportunity, you should have reasons as to why you’re doing what you’re doing.

For quality investors, it’s about the golden trinity: ROIIC, reinvestment rate, cyclicality. In the world of options, it’s the following five factors: strategy, product, , probability of profit, implied volatility, scaling/sizing.

If our quality stocks become cheaper and drop below our minimum allocation of 70%, we’re likely to buy more shares (direct stock ownership), and shift some of our cash funds to our long-term brokerage account. The only exception would be if none of our existing holdings and those that are on the watchlist are likely to deliver the 12% (or better) IRR target.

Life is unpredictable, so we personally want to have sufficient cushion in case of an attractive opportunity. It’s worked well for us, but we don’t expect any of you to copy what I’m discussing/doing (that’s where the disclaimer comes into play ;-)).

The objective is threefold:

earning a 10% IRR on my total investable wealth

reducing correlation with a traditional 70% stocks/30% bonds strategy; the traditional concept has some serious flaws

staying invested for the long run - the last thing we want do is interrupt our quality companies’ compounding

Volatility = Opportunity

With volatility comes opportunity, and what we’ve seen over the years is that it’s tough for many investors to buy into weakness and sell into strength. They’ll do the opposite: wait for good and low-volatile times to start investing, and perhaps even increasing their allocations beyond their initial plan.

That’s where a simple yet effective options strategy reduces risk, increases the probability of profit, earns you a return if nothing happens, and allows us to remain flexible with excess cash.

Let’s give a practical example of a stock that’s in our options portfolio today.